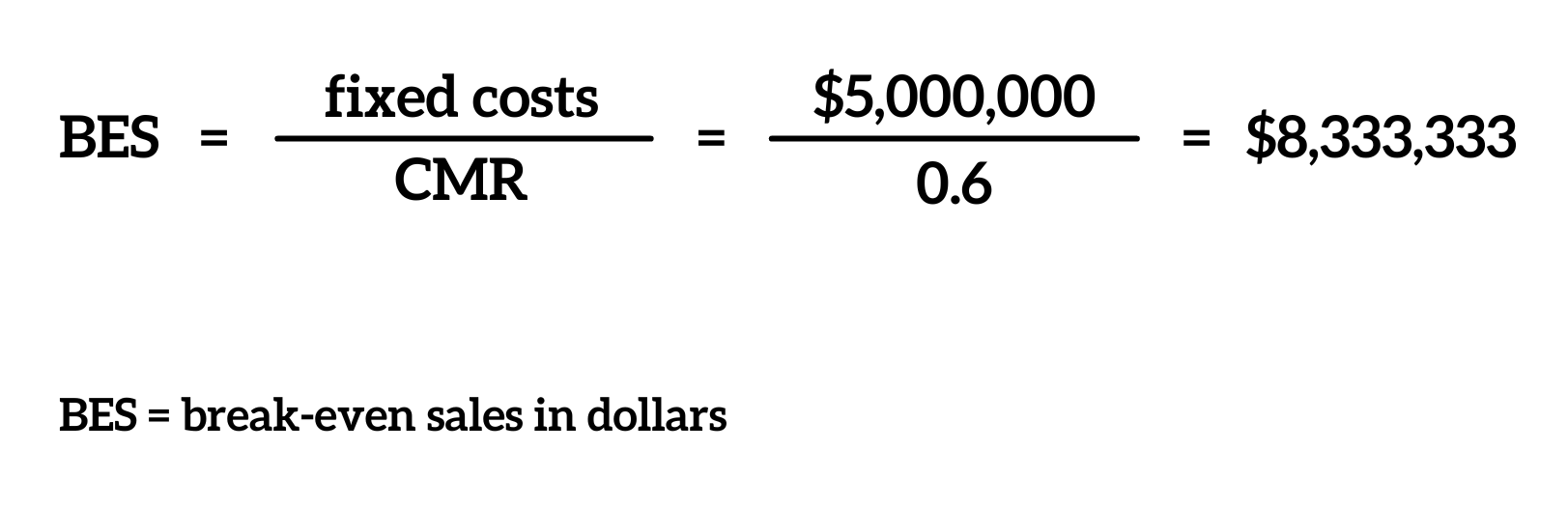

So, it is an important financial ratio to examine the effectiveness of your business operations. Fixed costs are the costs that do understanding online payroll not change with the change in the level of output. In other words, fixed costs are not dependent on your business’s productivity.

What is the Difference Between Contribution Margin and Gross Profit?

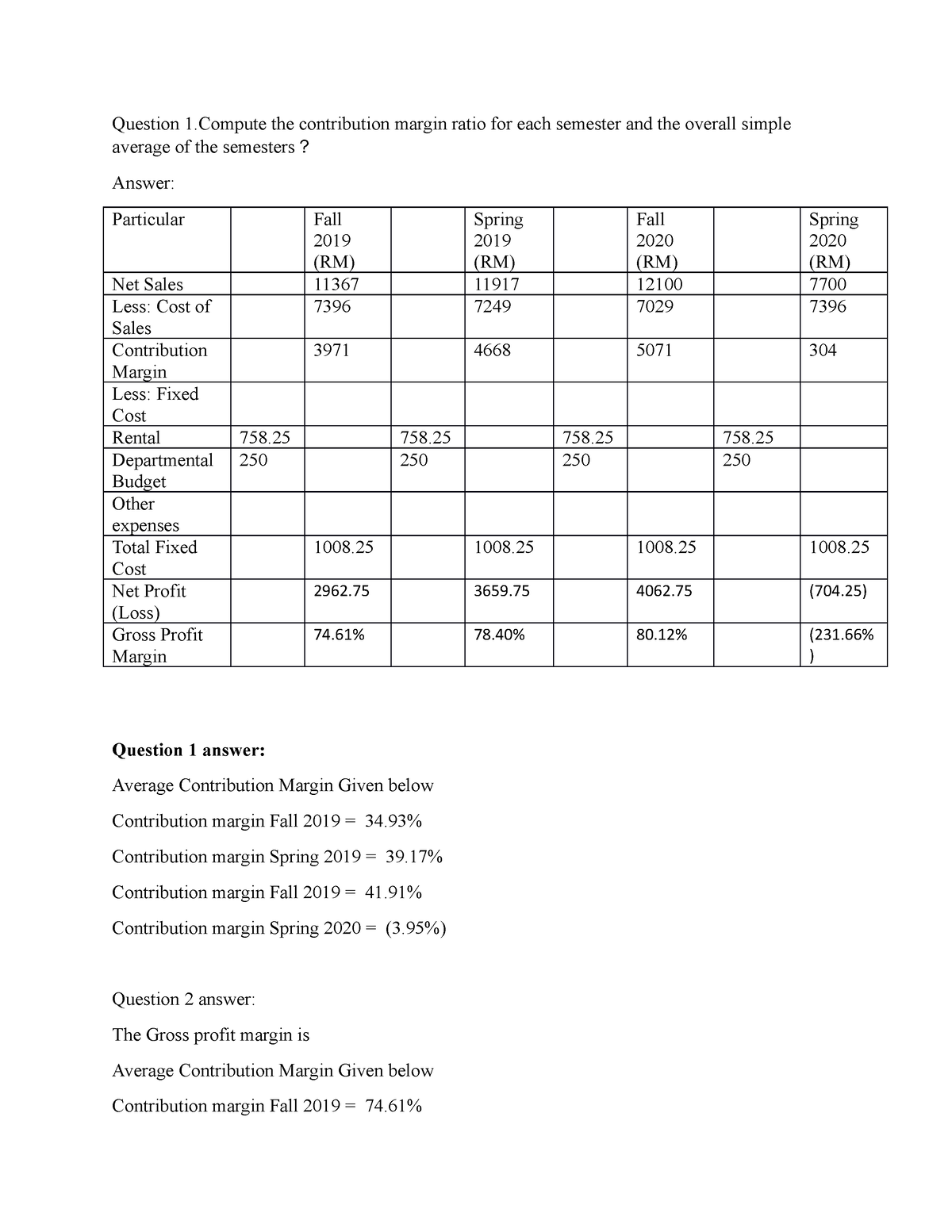

While it might sound similar to gross margin, contribution margin differs in its approach and utility. Gross margin subtracts both fixed and variable costs from sales revenue, providing a broader picture of profitability. In contrast, contribution margin focuses solely on variable costs, offering a more nuanced view of how each product or service contributes to covering fixed costs and generating profit. To understand how profitable a business is, many leaders look at profit margin, which measures the total amount by which revenue from sales exceeds costs. To calculate this figure, you start by looking at a traditional income statement and recategorizing all costs as fixed or variable. This is not as straightforward as it sounds, because it’s not always clear which costs fall into each category.

How to Calculate Contribution Margin?

Enter the selling price per unit, variable cost per unit, and the total number of units sold into the contribution margin calculator. The calculator will display the contribution margin amount and ratio in percentage. Variable costs are not typically reported on general purpose financial statements as a separate category. Thus, you will need to scan the income statement for variable costs and tally the list. Some companies do issue contribution margin income statements that split variable and fixed costs, but this isn’t common.

Is the Contribution Margin Ratio a good measure of profitability?

- The contribution margin may also be expressed as a percentage of sales.

- The contribution ratio is a measurement of your overall financial health.

- The contribution margin ratio refers to the difference between your sales and variable expenses expressed as a percentage.

- Accordingly, the Contribution Margin Per Unit of Umbrella would be as follows.

- It is expressed as a percentage and illustrates what portion of each sales dollar contributes to covering fixed costs and generating profit.

For instance, in Year 0, we use the following formula to arrive at a contribution margin of $60.00 per unit. If the contribution margin is too low, the current price point may need to be reconsidered. In such cases, the price of the product should be adjusted for the offering to be economically viable. The contribution margin is given as a currency, while the ratio is presented as a percentage. Find out what a contribution margin is, why it is important, and how to calculate it.

The contribution margin is computed as the selling price per unit, minus the variable cost per unit. Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company. Regularly calculating your contribution margin—monthly or quarterly—helps you stay on top of your financial performance.

Why contribution is important in financial management?

This analysis can aid in setting prices, planning sales or discounts, and managing additional costs like delivery fees. For example, a company aspiring to offer free delivery should achieve a scale where such an offering doesn’t negatively impact profits. Based on the contribution margin formula, there are two ways for a company to increase its contribution margins; They can find ways to increase revenues, or they can reduce their variable costs. Yes, the Contribution Margin Ratio is a useful measure of profitability as it indicates how much each sale contributes to covering fixed costs and producing profits. Management uses the contribution margin in several different forms to production and pricing decisions within the business.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

By knowing the exact contribution of each product to the overall profit, businesses can make informed decisions about pricing adjustments. For instance, if a product has a high contribution margin, it might justify a higher selling price, while products with lower margins might need cost reductions or even discontinuation. This means that for every dollar of goods sold, 60 cents contribute to covering fixed costs and profit. The contribution margin represents the revenue that a company gains by selling each additional unit of a product or good.

This is because it would be quite challenging for your business to earn profits over the long-term. The contribution margin ratio is also known as the profit volume ratio. This is because it indicates the rate of profitability of your business. Reduce variable costs by getting better deals on raw materials, packaging, and shipping, finding cheaper materials or alternatives, or reducing labor costs and time by improving efficiency. Increase revenue by selling more units, raising product prices, shrinking product size while keeping the same cost, or focusing on selling products with high margins.

Also, it is important to calculate the contribution margin to know the price at which you need to sell your goods and services to earn profits. Contribution margin is used to plan the overall cost and selling price for your products. Further, it also helps in determining profit generated through selling your products. Contribution Margin refers to the amount of money remaining to cover the fixed cost of your business.

Instead, management uses this calculation to help improve internal procedures in the production process. Yes, it means there is more money left over after paying variable costs for paying fixed costs and eventually contributing to profits. Contribution margin is the remaining earnings that have not been taken up by variable costs and that can be used to cover fixed costs. Profit is any money left over after all variable and fixed costs have been settled.